Home value depreciation calculator

Start by subtracting the initial value of the investment from the final value. A 250000 P 200000 n 5.

How To Calculate Depreciation On Rental Property

Understanding your homes worth allows you to estimate the.

. It allows you to figure out the likely tax depreciation deduction on your next investment property. There are many variables which can affect an items life expectancy that should be taken into consideration. In this case he could multiply his purchase price of 100000 by 25 to get a land value of 25000.

There are many variables which can affect an items life expectancy that should be taken into consideration. This is the first Calculator to draw on real properties to determine an accurate estimate. Ad Get the Details About Any Home in the Country.

Using the above example your basis in the housethe amount that can be depreciatedwould be 99000 90 of 110000. First one can choose the straight line method of. Now that you know the basics of the property and the homes value you should also assess your origin in the place.

Just Enter the Address and Hit Search. The four most widely used depreciation formulaes are as listed below. The assessors opinion of value can be found for free on most city or county websites.

Depreciation asset cost salvage value useful life of asset. The calculator should be used as a general guide only. The next again year the depreciation value is 810 and so on.

Ad Search all homes for sale in the Phoenix and Scottsdale metros. Calculate the average annual percentage rate of appreciation. This calculation gives you the net return.

Straight Line Depreciation Method. The value of the home after n years A P 1 R100 n Lets suppose that the. Knowing the estimated value of your own home helps you price your home for sale as a precursor to an official home appraisal.

It provides a couple different methods of depreciation. Enter the original purchase price of your home and current estimated value to find out the the Annual Home. Check out the percentage increase of your home value with this calculator.

Annual Depreciation Expense 2 x Cost of an asset Salvage ValueUseful life of an asset Or The double declining balance depreciation expense formula is. Depreciation Expense 2 x. Using the above example your cause in the housethe.

Ad Calculate Your Homes Estimated Market Valuation by Comparing the 5 Top Estimates Now. This depreciation calculator is for calculating the depreciation schedule of an asset. The calculator should be used as a general guide only.

Divide the net return by the initial cost of the investment. Also includes a specialized real estate property calculator. Try Our Instant Home Value Estimator to Determine the True Value of Any Home.

Your basis in the land would be 11000. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

Appliance Depreciation Calculator

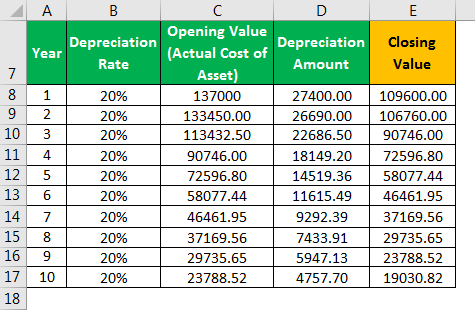

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

How To Use Rental Property Depreciation To Your Advantage

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Appreciation Depreciation Calculator Salecalc Com

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator Straight Line Double Declining

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com